Bitcoin prices in derivatives contracts on Binance are currently about $40–$50 lower than spot prices. This spread is significantly wider than in previous market cycles, even as Bitcoin trades near its all-time high (ATH).

This marks a notable deviation from past trends and raises questions among investors about what it means in today’s market environment.

Why Are Bitcoin Derivatives Priced Lower Than Spot?

During 2021–2022, when derivatives prices fell below spot prices, it often signaled a bear market. At that time, this kind of spread usually came with steep price drops, reflecting bearish sentiment and selling pressure from traders.

On the other hand, when derivatives traded higher than spot, it typically indicated a bull market. Bitcoin would then continue reaching new highs.

However, the current situation is very different. Despite Bitcoin hitting all-time high levels, derivatives prices are falling further below spot. This suggests that new market forces may now be in play.

Alphractal believes one possible reason behind this phenomenon is pressure from institutional players.

“This may reflect institutional hedging, arbitrage, or ETF dynamics,” Alphractal stated.

João Wedson, the founder of Alphractal, added that this situation might lead to a short squeeze. A short squeeze happens when Bitcoin’s price suddenly spikes, forcing short sellers to buy back BTC to cover their positions. Their urgent buying increases market demand.

“If the BTC perpetual price difference on Binance turns positive again, it’s a sign that the price is about to explode. Until that happens, we can say that many institutions are already putting pressure through Shorts, which could be good for a possible Short Squeeze since they’re going against the OG Whales,” Joao Wedson explained.

Crypto Rover Predicts a Massive Bitcoin Short Squeeze

In his latest analysis video, Crypto Rover also emphasized that the largest Bitcoin short squeeze is about to unfold.

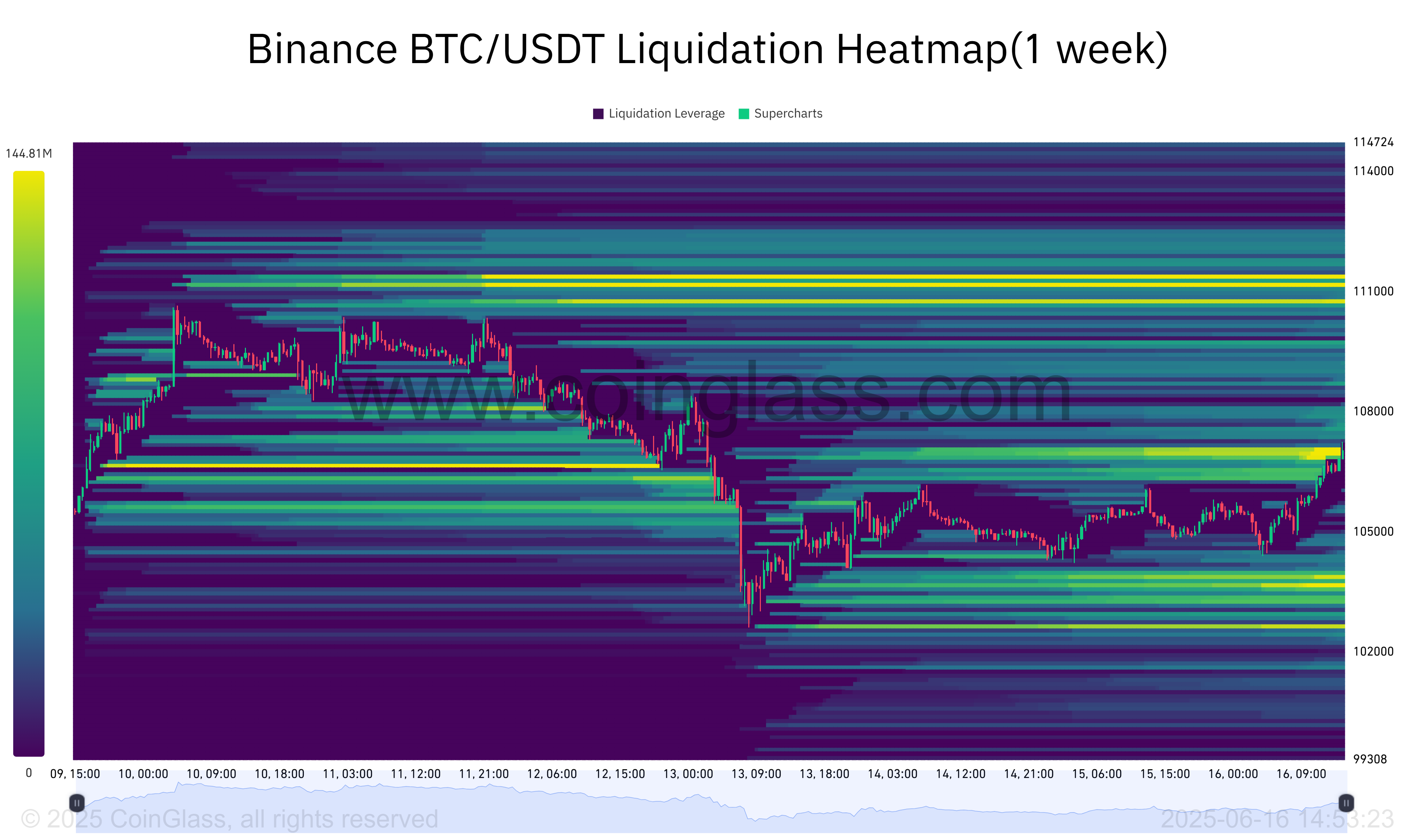

According to him, the sensitive price zone for Bitcoin lies around $110,000–$111,000. This is where a large amount of liquidity is concentrated. If Bitcoin’s price crosses this zone, many short positions will be liquidated. That could trigger a new wave of explosive upward momentum.

“So it’s very important to break above this high here. And whenever we do so, we’ll probably be moving up rapidly again… I am seeing major amounts of liquidity right now piling above us around $110,000–$111,000. There are just major amounts of Bitcoin short liquidation piling up here,” Crypto Rover predicted.

João Wedson’s explanation and Crypto Rover’s prediction both suggest that the current price spread could be a bullish signal for Bitcoin. However, this view diverges from historical patterns.

It shows that the market is entering a new, unprecedented phase. This shift complicates short- and long-term forecasts, making price movements harder to predict than ever.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.