The following is a guest post from Shane Neagle, Editor In Chief from The Tokenist.

The steady Bitcoin trickle into the mainstream consciousness since 2009 mainnet launch had many cascading effects. First, it served as a revelatory vehicle by exemplifying the nature of money; why it should be outside of central banking, and why fixed supply is important for the valuation of money.

Second, Bitcoin sparked an entire crypto industry, further making the case for decentralized financial services that eliminate gatekeepers in favor of smart contracts enforced by blockchain networks. As this $2.2 trillion sector develops, banks are further poised to lose their role as trusted intermediaries.

Third, data center infrastructure is becoming more important than ever. Whether home-based or as large mining operations, crypto infrastructure needs reliable high-performance computing resources, storage capacity and memory alongside fast networking to maximally reduce blockchain latency.

In fact, data centers are so critical that an entire knowledge field emerged to balance power requirements, cooling solutions, server density and crypto hosting location. When these factors come together, crypto needs to forge an indelible mark on the data center design itself. Let’s explore how.

The Critical Role of Data Centers in Crypto Infrastructure

In the early days of the internet, broadband connection was rare. This necessitated local resources within businesses and institutions to be used for data storage and management. By the end of 2000s, broadband infrastructure had become sufficiently ubiquitous to start supporting cloud computing.

In other words, data centers were being delocalized into remote, scalable, on-demand server clusters. The ability to eliminate on-premise infrastructure and host data and apps remotely drastically cut upfront capital expenditure. Of course, this ultimately benefited Amazon Web Services (AWS), Microsoft Azure and Google Cloud as the data center triumvirate that powers the bulk of today’s digital landscape.

However, securing blockchain networks exerts an entirely new load layer. Because these digital ledgers facilitate real-time transaction processing, between multiple nodes to verify them, extra CPU, GPU power and RAM is needed to minimize congestion and latency.

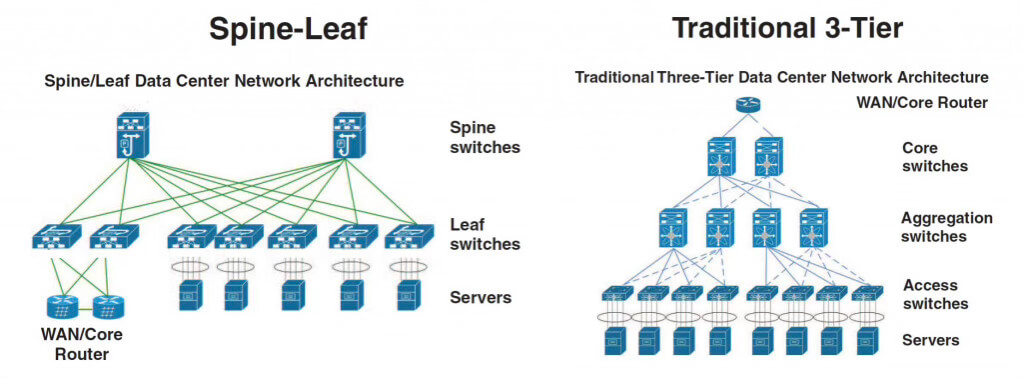

And if there is a sudden spike in blockchain network traffic, this too requires resource redundancy. This is why both AI and blockchain-oriented data centers have been transitioning from traditional client-to-server architecture (north to south) to spine-and leaf architecture (east to west).

The spine-leaf approach makes for a non-hierarchical design that allows data to flow horizontally between servers. This is critical for blockchain networks, as each node directly communicates with other nodes without having to go through a congestible central point.

Therefore, a spine-leaf architecture alleviates bottleneck and single point failure potential. Because this mirrors the spirit of crypto decentralization and peer-to-peer (P2P) communication, spine-leaf data centers have become the new standard for blockchain reliability and security.

Energy Consumption and Efficiency Challenges

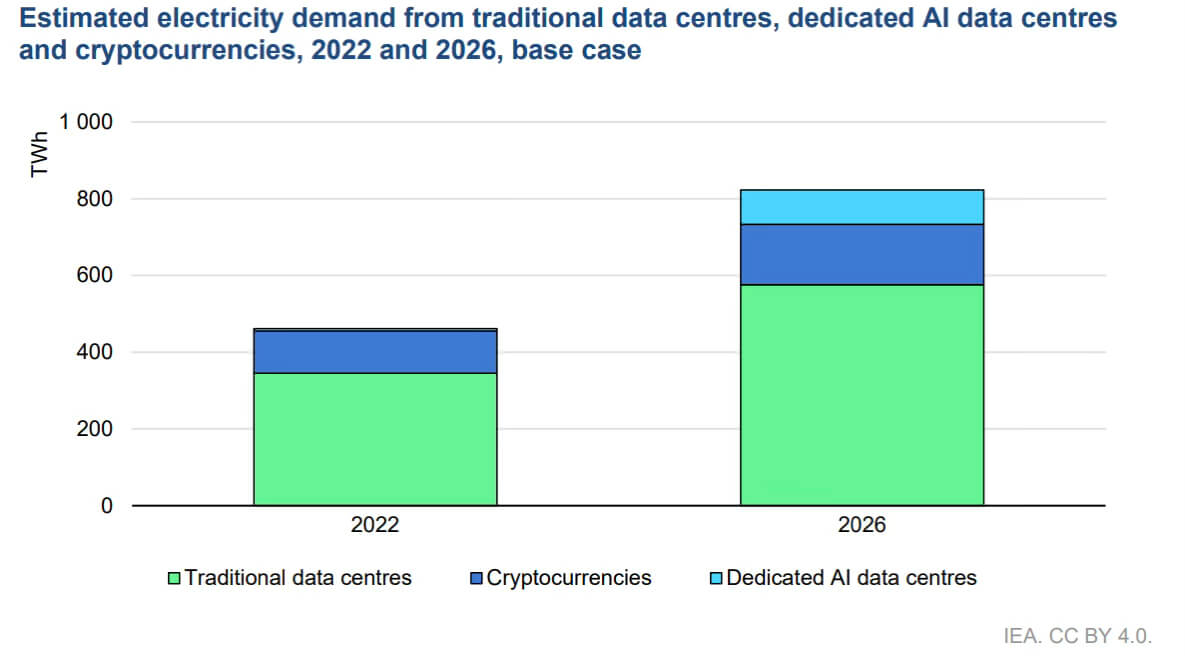

As blockchain networks need greater compute power to validate transactions and execute smart contracts, so is there greater need for energy consumption. By 2022, blockchain networks have already carved a significant proportion of data center electricity demand.

According to the International Energy Agency (IEA), the data sector servicing the crypto industry globally consumed 460 TWh in 2022, which is forecasted to more than double by 2026.

For comparison, France consumed 447 TWh annually in 2021. These trends clearly point to a reliable source of power, which is why Microsoft saw fit to make a 20-year deal with Constellation Energy to restart Unit 1 nuclear reactor in 2028.

In Europe, the European Commission even designated Small Modular Reactors (SMRs) as “green” to balance decarbonisation efforts with increased electricity demand. But raw power capacity is only the beginning of scaling.

To make crypto-oriented data centers more efficient, they are moving closer to power plants. This is best exemplified by Bitcoin. The primary cryptocurrency uses a proof-of-work algorithm to secure the network, effectively anchoring Bitcoin in the physical world of energy and hardware assets.

This is what ultimately gives Bitcoin its value as decentralized money and global transfer of wealth. In essence, Bitcoin represents digital energy. But because power is lost over long distance electrical transmission, due to copper/aluminum resistance, it would be wasteful to erect crypto data centers just anywhere.

Rather, they should be as close to power plants as possible to minimize transmission loss. Case in point, the New York state power plant bypasses state level network by directly plugging in thousands of servers. Likewise, Ward Roddam, mayor of Rockdale, Texas, recently made the case that Bitcoin mining can revitalize communities by investing to siphon excess energy and stabilize the electric grid with flexible load demand.

“Riot Platforms is building a state-of-the-art facility in Corsicana, which will be one of Navarro County’s largest employers. The mine could bring $1.4 billion in taxable purchases and over $115 million in wages over the next decade.“

Another crypto mining company, TeraWulf, has been building its Nautilus Cryptomine adjacent to the Susquehanna nuclear power plant, now in the hands of Talen Energy. This will be the first zero-carbon, nuclear-powered Bitcoin mining facility.

With a 200 MW capacity, this would be the equivalent to ~160,000 US households’ energy consumption annually.

Adapting Data Center Design for Blockchain Technology

In addition to spatial proximity to reduce transmission loss, data centers servicing blockchain networks need particular mechanical, electrical and plumbing (MEP) requirements. As every PC owner knows, the source of such requirements at large scale comes from heat management.

Continuous solving of cryptography puzzles requires great computing power which generates heat. For many years, air cooling has been the go-to solution to prolong hardware longevity and dissipate heat. Unfortunately, cooling also draws significant energy on top of computing itself.

This is why there is a new trend to rely more on direct-to-chip liquid cooling (immersion cooling) which cuts down on power usage.

₿𝗥𝗘𝗔𝗞𝗜𝗡𝗚: 33,000 new immersion-cooled #bitcoin mining computers connect online today. This 100 megawatt facility is now the largest electricity user in Sadersville, Georgia. pic.twitter.com/5TzqF9f3IT

— Documenting ₿itcoin 📄 (@DocumentingBTC) February 13, 2024

But even so, these types of data centers need advanced HVAC control systems and capacity to handle thermal loads. Equally so, high-power-density clusters, at 20 – 40 kW per rack, require larger power transformers, backup systems and high-capacity power distribution units (PDUs).

For example, Crypto Minotaur PDU can handle up to 92.4kW worth of power density. Lastly, to ensure continuous blockchain workloads, such data centers typically rely on backup redundancy via natural gas or diesel power generators coupled with automatic transfer switches (ATS).

Tier Adjustments and Cost Management

Those familiar with the inner workings of Bitcoin code know that its security is derived from the concept of Byzantine Fault Tolerance (BFT). In short, even if multiple network nodes fail, the consensus on the current state of the ledger is still achieved.

In data center design, this means that blockchain miners have to account for redundancy tiers according to the Uptime Institute:

- Tier I: Basic Capacity, no IT redundant equipment, downtime up to 1729 minutes

- Tier II: Redundant Capacity – equipment failure less likely to lead to network downtime (1361 minutes)

- Tier III: Concurrently Maintainable – thanks to duplicate IT equipment, maintenance and expansion doesn’t lead to downtime (95 minutes)

- Tier IV: Fault Tolerance – parallel cooling and power systems for minimal downtime potential (26 minutes)

Of course, as each tier increases redundancy, so does it increases the cost. Large companies with deep pockets can afford such scaling and then attract smaller businesses into their cloud computing ecosystems.

Case in point, Microsoft Azure’s data center infrastructure is certified as ISO/IEC 27001:2013 and NIST SP 800-53 for network security and reliability, which is the prerequisite to achieve Tier IV level of fault tolerance.

However, such redundancy is not strictly necessary for Bitcoin needs, as other nodes around the globe can take up the slack. Bitcoin’s 10-minute block confirmation interval was intentionally picked by Satoshi Nakamoto to inject inherent redundancy in the network.

Nonetheless, this may not apply to blockchain networks like Solana (SOL) or Avalanche (AVAX) with near-instant settlements that aim to supplant Visa-like money transfer systems. For activities like day trading, they would require maximum uptime provided by Tier IV data centers.

To that end, Solana Foundation formed the Solana Server Program. Its flexible month-to-month contracts rely on data center providers like Edgevana. Ethereum and Avalanche typically use AWS, Google Cloud and Tencent Cloud for the bulk of their server needs.

Viability of Crypto Mining Operations

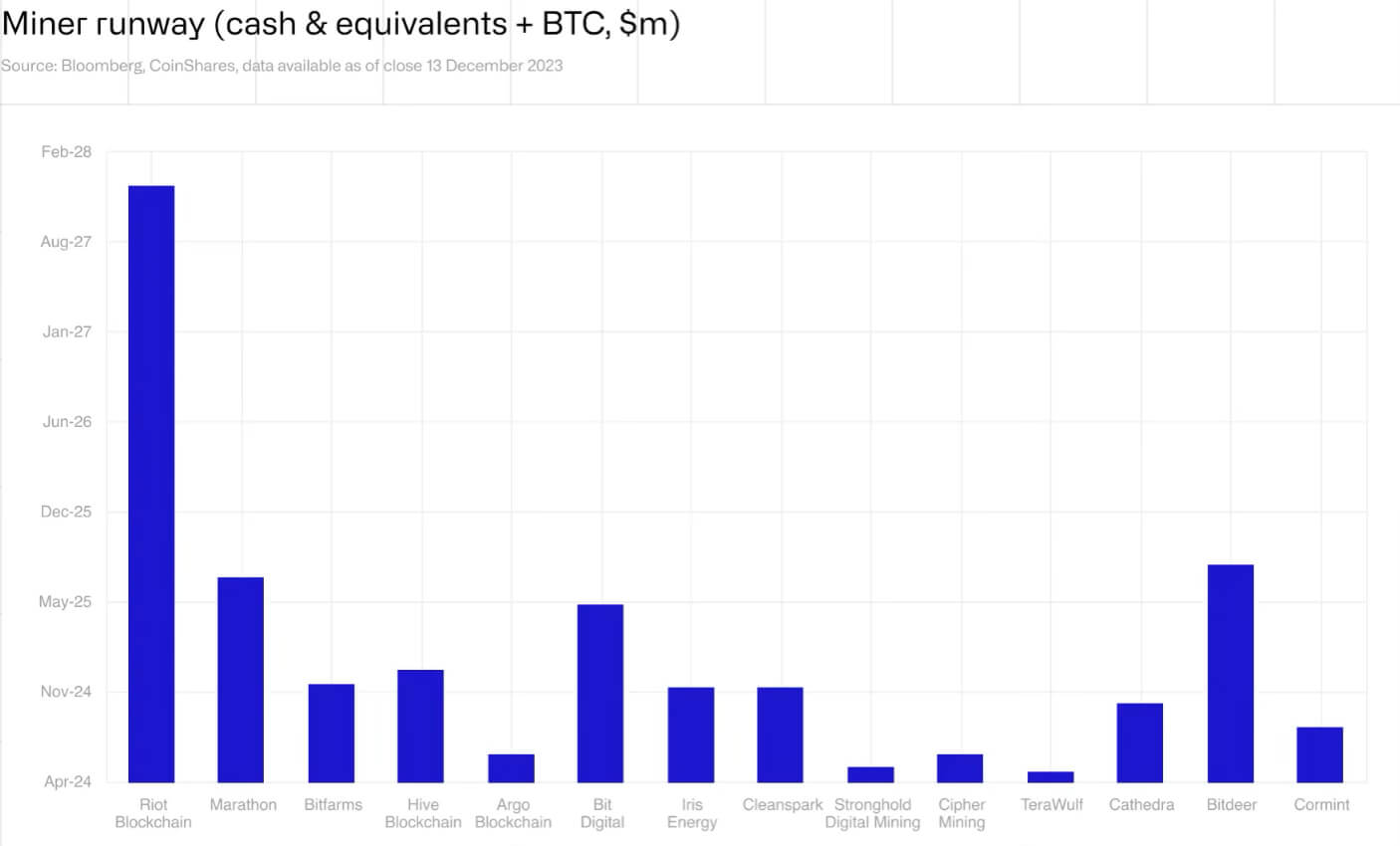

After the 4th Bitcoin halving in April, miners’ rewards were cut in half, from 6.25 to 3.125 BTC. At the same time, Bitcoin network difficulty increased from 86.3886 T to present 88.4044 T. It is further estimated that the next Bitcoin difficulty adjustment will increase by 3.81% on October 9th.

This translates to fewer payments for the same amount of computational exertion and energy consumption. Yet, this would exert a negative impact, to the point of bankruptcy, only if Bitcoin price were to fall under $40k, according to CoinShares’ report.

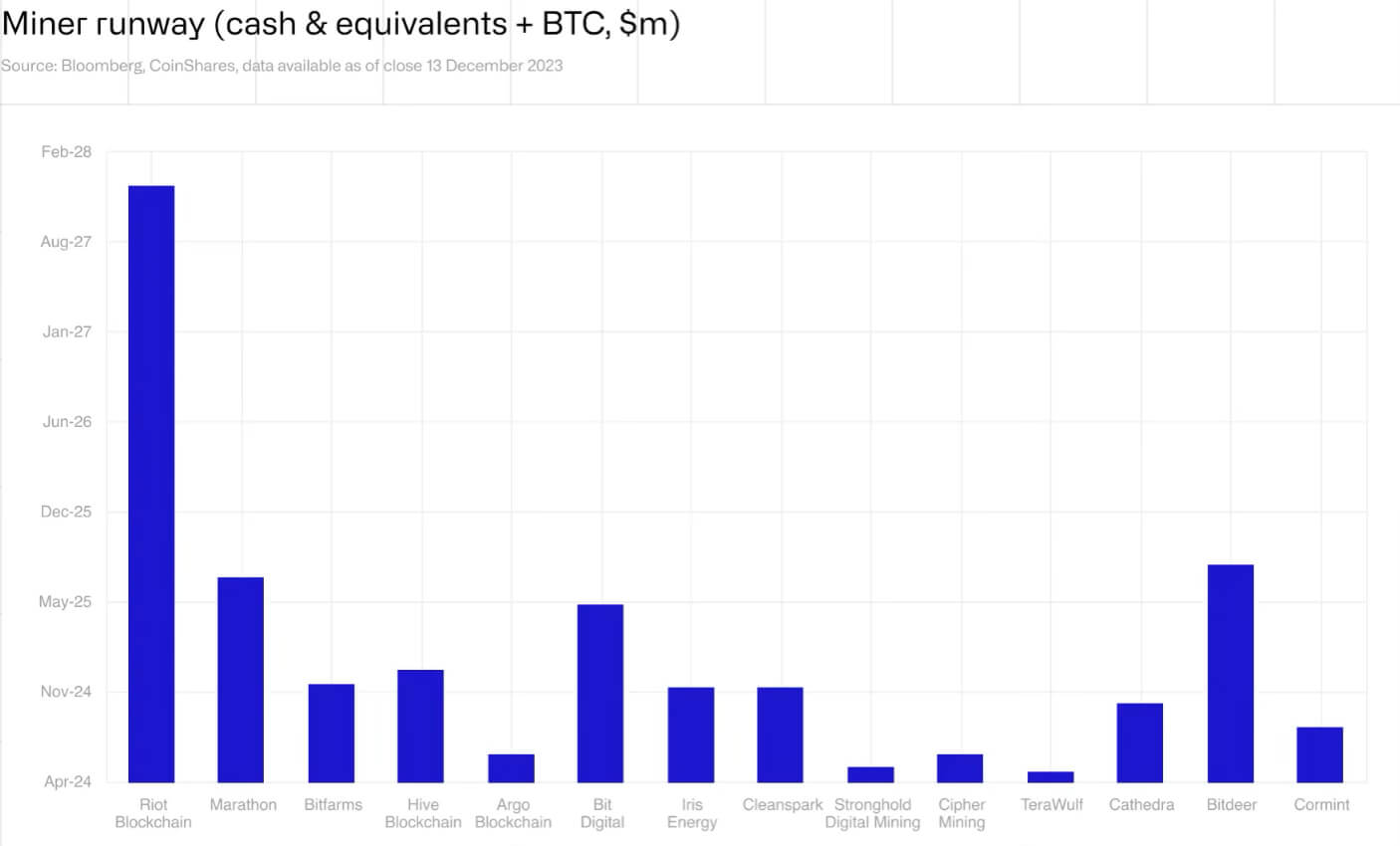

Taking into account the spectrum of initial capital expenditures, this translates to different cost runways for different mining companies.

Analyze the return on investment for crypto mining operations, particularly in light of recent reductions in Bitcoin mining rewards. Consider the potential for additional revenue streams, such as converting facilities for heat reuse.

But with major selling pressures out of the way, in particular from the German government and Mt. Gox payments, it is more likely that BTC price will go up rather than drop. Historically, BTC price achieves a new all-time high within ~18 months following the halving event.

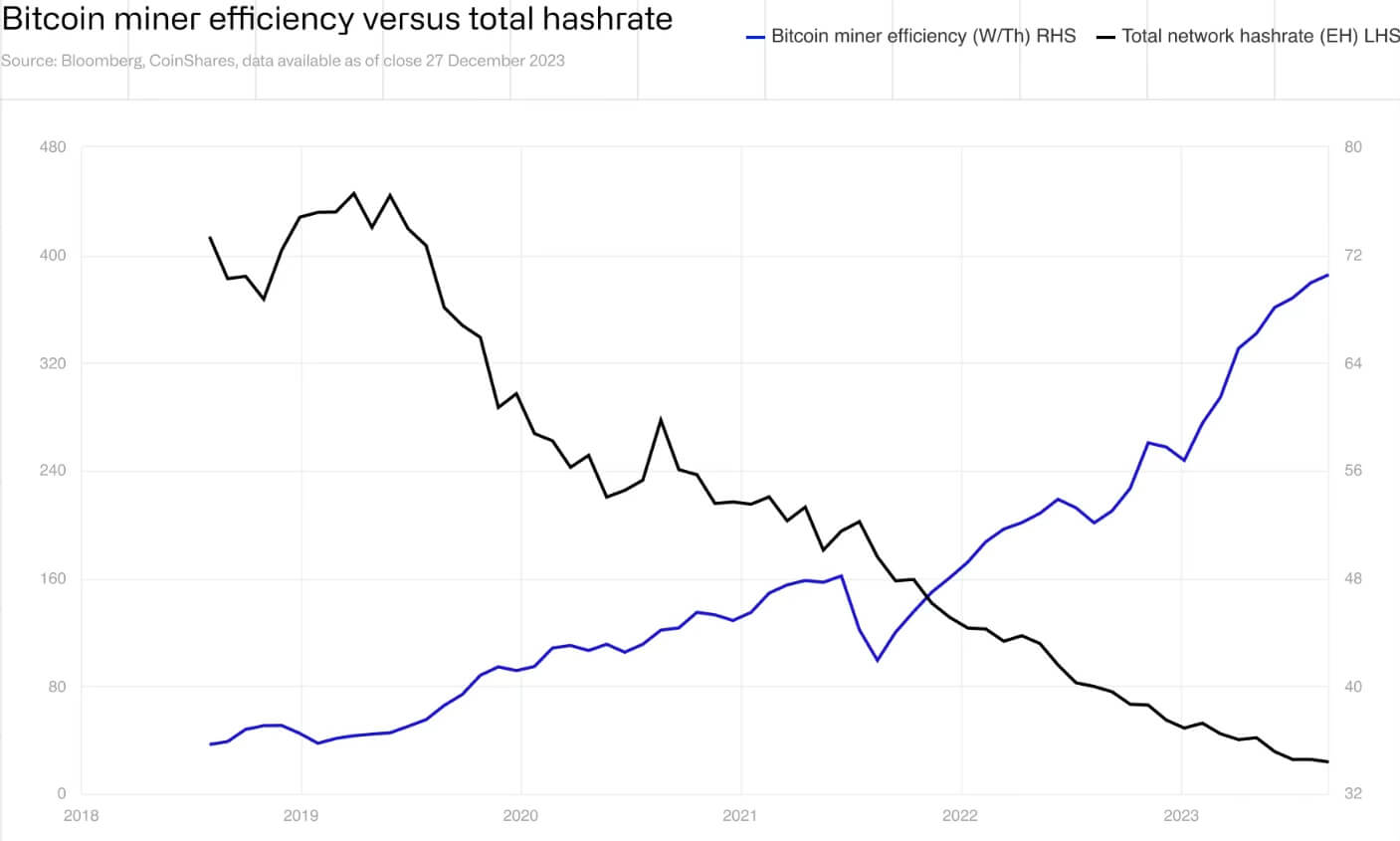

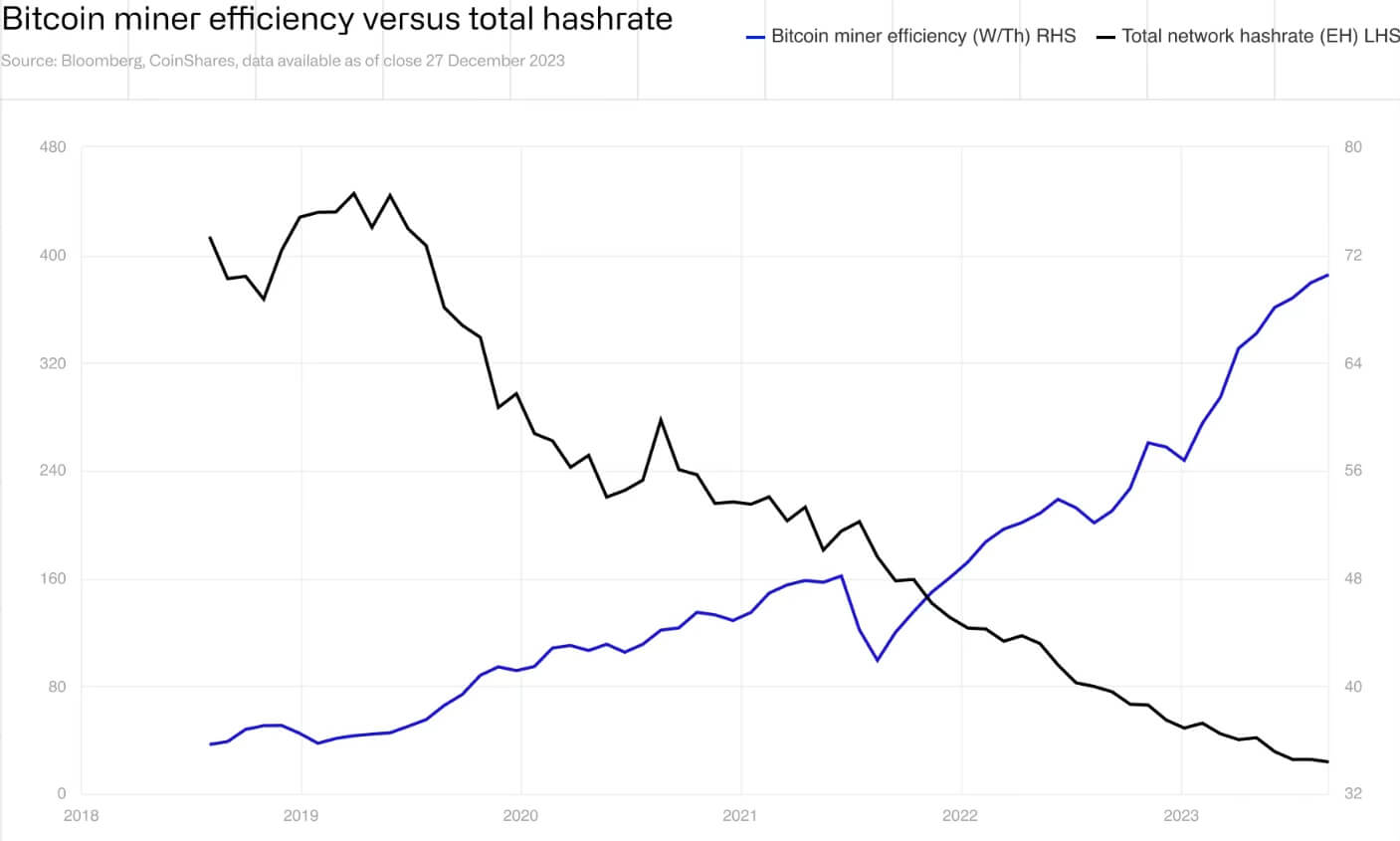

Moreso, the USG’s uncontrollable spending is likely to further cement Bitcoin’s case for sound money as the dollar’s value continues to gradually erode. Lastly, Bitcoin mining efficiency continues to improve, as noted by aforementioned cooling immersion and upgrades to newer ASIC machines such as Antminer S21.

Integrating Sustainable Practices into Crypto Mining

For an electric grid to remain stable (and usable) it has to balance periods of high and low demand. The Bitcoin network is ideally suited for this task as Bitcoin miners can adjust usage on the fly.

After Texas legislatures passed House Bill 591, Bitcoin data centers have a further role to play in energy sustainability. The bill allows oil and gas operators to sell vented/flared gas to on-site mobile data centers. This gas would otherwise be wasted as a byproduct of extraction.

Such redirection is estimated to reduce their carbon footprint by up to 63%. On top of this, Bitcoin data centers using immersion cooling can use that energy to heat water. Using this approach Canadian crypto miner startup MintGreen has been deploying Digital Boilers in Vancouver.

500 kVA for in-house Digital Boiler testing ♨️🌱 pic.twitter.com/KMhlgbFbej

— MintGreen (@MintGreenHQ) March 19, 2024

Excess data center heat could also be used to heat greenhouses, as showcased in the Netherlands by BloemBitcoin.

🌷 💨 pic.twitter.com/uEemmptSGg

— BitcoinBloem (@BloemBitcoin) March 4, 2023

If Bitcoin price gains new high ground in 2025 and beyond, it is not difficult to see greater mainstream acceptance of such innovative solutions.

Conclusion

Crypto mining first brought into focus large scale high-performance computing (HPC). For the longest time, this was met with hostility, often painted as wasteful. After BlackRock’s successful integration of Bitcoin via its IBIT ETF, such concerns have largely disappeared. Yes, this was the same BlackRock that pushed the Environmental, Social, and Governance (ESG) framework in the finance sector.

Crypto mining is now set to be overshadowed by generative AI infrastructure, benefiting from years of lessons learned in large scale data center deployment. Moreover, even crypto mining companies like Core Scientific and Iris Energy are adopting a hybrid approach by hosting both GPU servers for AI and ASIC machines for Bitcoin mining.

In the end, crypto data centers have proven to be anything but wasteful.

Mentioned in this article